News

Amazon stock slides after forecasting a major increase in CAPEX

AI

Leon Wilfan

Feb 6, 2026

13:00

Disruption snapshot

Amazon’s boosting capital spending to about $200B in 2026, mostly for AI, data centers, chips, and automation. That choice squeezes free cash flow and margins short term.

Winners: AWS, AI chip makers, power and data center partners. Losers: Amazon shareholders near term, third-party sellers, and smaller retailers that can’t match this scale.

Watch AWS capacity and pricing signals. Long-term AI compute contracts or guaranteed capacity would show the spend’s working, even as free cash flow looks rough.

Amazon (AMZN) has a Disruption Score of 2.

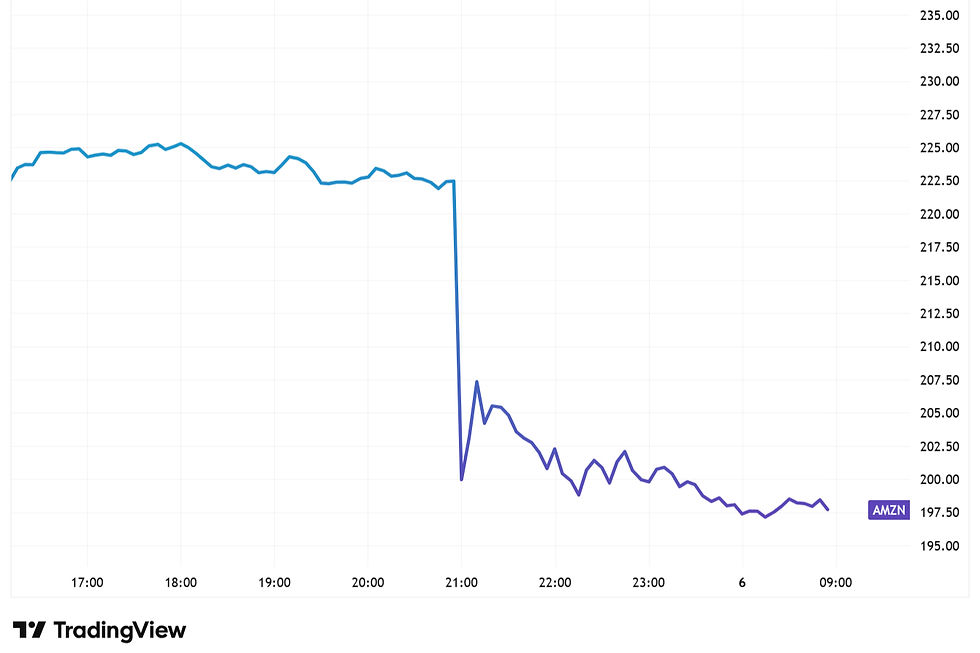

Amazon (AMZN) stock slid hard after the company told the market it’s about to light $200 billion on fire in capital spending, mainly focusing on the AI boom.

Amazon posted a mixed quarter, but it's the guidance that detonated the stock.

Earnings per stock came in at $1.95, a miss. Revenue beat expectations at $213.39 billion, but several core businesses underwhelmed. Online stores and subscriptions were fine. Physical retail and third-party seller services weren’t. North America margins improved. International margins fell apart.

Then there was Amazon Web Services. AWS was the bright spot. Revenue jumped 24% to $35.58 billion, the fastest growth in three years. Operating margin topped 35%. AI demand drove it, from chips to tooling to automation. That should’ve been enough to calm investors.

It wasn’t.

Amazon forecast first-quarter revenue below expectations and, more importantly, said capital spending will surge to roughly $200 billion in 2026. That’s about 50% higher than 2025 and way above what Wall Street had modeled. After hours, the stock dropped as much as 11%. Recently, Google also announced that it will double its CAPEX in 2026.

The disruption behind the news: Two hundred billion dollars is industrial scale expansion.

Data centers. Custom AI chips. Robotics in fulfillment. Power infrastructure. Logistics density.

Amazon is rebuilding its cost base upward to lock in the next decade of demand before competitors can catch up.

Here’s the uncomfortable truth for investors.

Amazon is intentionally compressing free cash flow to make itself impossible to compete with later. That spending wave will pressure margins for at least two years. The stock market hates that. Businesses that depend on Amazon should pay attention.

AWS is the key. AI workloads are expensive, power-hungry, and capacity-constrained. If Amazon doesn’t build now, it risks losing enterprise customers to rivals that can guarantee compute at scale. Every hyperscaler is racing to pour concrete and wire substations. Amazon just admitted it plans to spend more than almost anyone.

For retail, this spending accelerates automation. More robotics means fewer humans per package. That lowers unit costs long term but requires massive upfront capital. Smaller retailers can’t match that move. Third-party sellers will feel it through higher fees and stricter performance thresholds as Amazon pushes efficiency harder.

There’s also a geopolitical angle. Power and land are now strategic assets. Data centers don’t scale without local approvals, grid upgrades, and long-term energy contracts. Amazon is buying optionality years ahead of need.

The market reaction isn’t irrational. A $200 billion build cycle ties up cash and increases execution risk. But strategically, this is Amazon choosing dominance over comfort.

What to watch next

First, watch AWS pricing and capacity commitments over the next 6 to 12 months.

If Amazon starts offering longer-term AI compute contracts, this spending is already paying off.

Second, track free cash flow rather than headline earnings.

Expect it to look ugly. That’s the point.

Third, watch competitors’ capital plans.

Anyone not matching this pace will slowly become irrelevant in AI infrastructure.

Finally, watch regulation.

Power usage, land acquisition, and data sovereignty will pull Amazon deeper into political fights globally.

Amazon stock sliding can be a sign of overspending. But it is not. They are pre-spending on the future. Investors can flinch, but competitors should be scared.

Amazon (AMZN) has a Disruption Score of 2. Click here to learn how we calculate the Disruption Score.

Recommended Articles