News

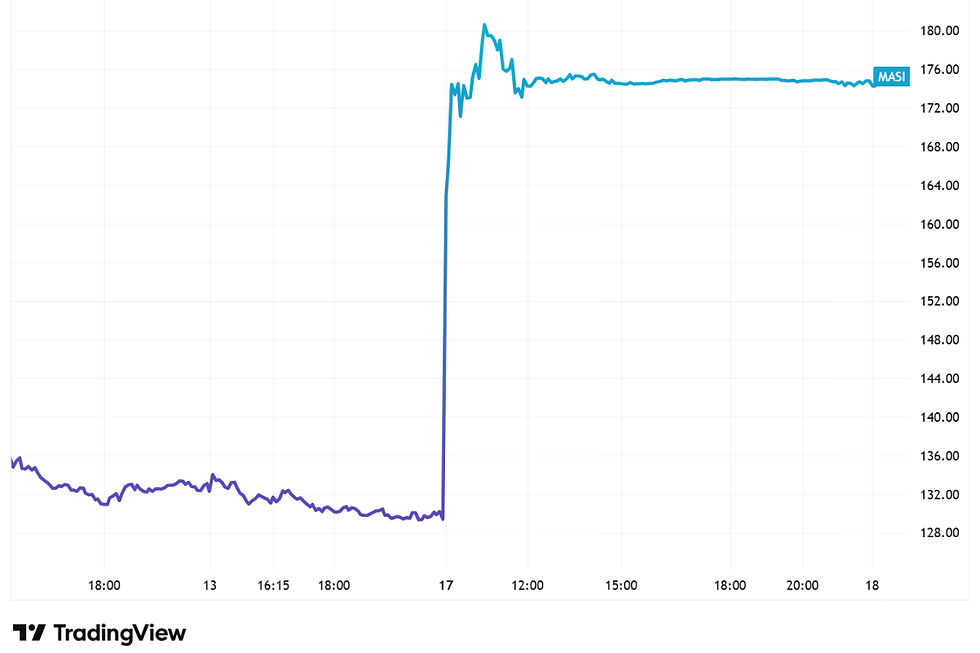

Masimo stock surges 34% after $9.9 Billion Danaher deal

Biotech & Health Tech

Leon Wilfan

Feb 18, 2026

17:30

Disruption snapshot

Danaher will buy Masimo for $9.9B in cash at $180 per share, a 38% premium. Masimo will stop operating independently and fold into Danaher’s Diagnostics segment.

Winners: Masimo shareholders and scaled medtech platforms with global sales reach. Losers: standalone mid-cap medtech firms that lack distribution muscle and now face stronger bundled competition.

Watch regulatory approval and post-close growth. If Masimo’s revenue growth accelerates and bundled pricing holds firm, Danaher’s distribution leverage thesis is working.

Masimo (MASI) and Danaher (DHR) have a Disruption Score of 2.

Health-tech Masimo (MASI) stock jumped 34% after Danaher (DHR) agreed to buy the company for $9.9B in cash, offering $180 per share.

That is a 38.3 percent premium to where Masimo closed just days earlier.

Investors immediately repriced the company to $174.69, ending a short slide and signaling they believe this deal will close.

Masimo will become a standalone business inside Danaher’s Diagnostics segment once the transaction wraps in the second half of the year. No earnings call this month. No independent future. Just a clean handoff to one of the most disciplined serial acquirers in medtech.

Danaher stock fell almost 3 percent on the day. That is the market doing short term math on acquisition cost. Masimo holders just got paid.

The disruption behind the news: Danaher just bought infrastructure leverage, not just Masimo.

This is not just a buyout, but a distribution hack.

Masimo built a strong franchise in patient monitoring, especially pulse oximetry and hospital based monitoring systems.

But scaling global medtech is brutally expensive.

Regulatory approvals, hospital sales cycles, procurement contracts, service networks. These are infrastructure problems.

Danaher owns that infrastructure.

By folding Masimo into its Diagnostics machine, Danaher can push Masimo’s monitoring tech through an installed base that spans thousands of hospitals and labs worldwide. Sales reps who already walk into procurement offices can now bundle monitoring solutions alongside diagnostics platforms. That lowers customer acquisition cost overnight.

A 38 percent premium is not just a reward to Masimo investors. It is a signal that distribution leverage is worth billions. If Danaher can accelerate Masimo’s revenue growth even a few percentage points annually across global markets, the $9.9B price tag starts to look conservative over a five to seven year horizon.

For competitors, this tightens the vise. Standalone medtech firms now face a buyer with deeper pockets, broader reach, and tighter integration across diagnostics and monitoring. Hospitals under cost pressure prefer fewer vendors, not more. Bundling wins.

For founders in digital health and hardware enabled care, this reinforces the exit map. Build differentiated clinical tech. Prove outcomes. Then plug into a giant with regulatory muscle and global sales coverage. The public markets have been punishing mid cap medtech. Strategic buyers are stepping in.

What to watch next

First, regulatory review.

Large medtech consolidation always invites scrutiny, especially in diagnostics. Any delay stretches integration timelines and injects uncertainty into Danaher’s capital allocation strategy.

Second, integration velocity.

Danaher has a reputation for operational discipline. If Masimo’s growth rate accelerates within 12 to 18 months post close, that validates the thesis that distribution scale beats independence.

Third, competitive response.

Expect rivals to pursue defensive M and A or deeper partnerships. The next 6 to 24 months could see a clustering effect in patient monitoring and adjacent diagnostics categories.

Finally, pricing power.

If Danaher uses its scale to hold or raise pricing on bundled offerings, that changes margin math across the sector. If it discounts to gain share, smaller players will feel it fast.

This deal tells you something simple. In healthcare tech, distribution is destiny. Build it or get bought by someone who has it, as the Masimo stock reaction clearly shows. Health-tech is one of the 7 disruptive technologies that will change the world. Masimo (MASI) and Danaher (DHR) have a Disruption Score of 2. Click here to learn how we calculate the Disruption Score.

Recommended Articles